Through the increased popularity in crowd funding an initial coin offering has often been one of the largest steps for a business to take in funding its initial rise. Sincere 2017 ICO’s have long been one of the most popular formats that are dominating tech crowd funding is a brand-new way to support a project. Unlike traditional crowd funding that rewards initial supporters with small tokens or prizes for supporting the business, an ICO can provide contributors an asset that they can buy sell and trade as the business grows

| Table of Contents |

- 1 The Tech behind ICO’s

- 2 Tolkens and smart contracts

- 3 The first ICO: Mastercoin

- 4 The world’s most successful ICO’s

- 5 What is EOS and Ethereum?

- 6 What is the difference between NEO and Ethereum:

- 7 Coins vs tolkens?

- 8 Can you just create your own cryptocurrency?

- 9 ICO ban and marketing:

- 10 Conclusion

1-The tech behind ICOs:

Initial coin offerings utilize block chain technology is one of the top assets for the backing in their database. The database itself is considered to be public because it shared amongst hundreds of computers to start and then eventually thousands of computers to verify the data. The easiest way to imagine this technology is to think of each one of the computers that verify the data to be like a server for the database. Although the data is stored and verified on many different pieces of hardware, it makes up a full system.

One of the biggest reasons for so many pieces of hardware making of the network is verifiable security for the database. Changes that are made across this public database also need to be verified by around 51% of the computers across the network. 51% of the computers on the network will be responsible for confirming changes as soon as they are made and this makes the process of hacking the database nearly impossible. In order to manipulate results within the block chainhacker would have to be responsible for manipulating 51% or more of the computers on the network in order to confirm the changes that they made.

Because there is no central database that controls everything, the network is considered to be decentralized. There is no specific owner or entity controlling the network, rather it is maintained by people buying and selling the coins. The value of the trades within the blockchain of an ICO ultimately come down to the value that people place on it. The value of one of these coins could represent something that’s valuable intangible enough to exchange for real goods and services. The tokens will continue to fluctuate in price but eventually they can be representative tools of real currency when they start to hold value.

2-Tokens and smart contracts:

The tokens that are created across the network can also be considered something of value. Tokens themselves can’t be applied directly into the blockchain by a central party as the blockchain itself is responsible for processing transactions. Most of the ICO’s on the market today are built on the Ethereumblockchain or similar technology. The cryptocurrency tokens that are most common in these types of Blockchains are Bitcoin and Ether.

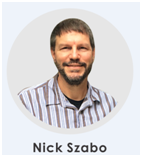

The transactions of these tokens across the network need to be translated by an application. Applications that use tokens also initiate functions known as smart contracts. The idea of a smart contract first got started in the year 1994 through cryptographer Nick Szabo. The goal was to create a assignable contract using computer codes that could be activated automatically when conditions were met within the system. The contracts would be infallible because the results of the contract were verified within computer code.

A trusted third-party or witness is often needed in order to create a contract. Rather than having to pay a notary smart contracts can automatically be executed and then verified over the trust of the network. As computers completely control this network, there is no need for a legal presence and the process of contracts can be sped up significantly.

The basic conditions that need to be met for a smart contract include:

An automatic process for a transaction

A transactional trigger that occurs when a smart contract is met. Ie “When 800 ether is transferred, Evan will buy Gregs RV. Greg will transfer ownership as soon as the funds are confirmed. ”

These smart contracts using blockchain technology cannot be changed or edited without mass approval.

ICO’s are something that is equipped with smart contract technology immediately. Smart contract tokens or something that’s immediately needed for any ICO. A token and a smart contract are absolutely needed for any ICO to ensure that the system itself will not be subject to hacking. There’s no need for human interaction or manual distribution from an administrating body. Participants can also review the terms of each smart contract from an ICO.

Some of the main reasons why customers value smart contracts in ICO’s include:

The verifiability as the project continues to grow. As any company grows, the value of their ICO will also grow alongside it. The overall price of the tokens and coins will grow in demand and this is when there needs to be enhanced security for a token.

An ICO can also represent future value when exchanged for the product or services.

3-The first ICO: Mastercoin:

ICOs are similar to crowd funding in the same way that the kickstarter platform was so important to business finance. The difference between crowd funding platforms and ICO’s really comes down to the automated systems that are in ICOs. Today, an ICO can be considered one of the most popular ways to fund a new project. This technology was not always available and the creation of this text started with the first ICO back in the year 2013.

Mastercoin was the very first to launch and they published their white paper in 2012 with a proposed change to the bitcoin network. The first idea was to create a new protocol layer within the Bitcoin blockchain to account for smart contracts. This additional layer would allow companies and individuals to create new currencies.

This idea was eventually adopted by Etherium which is considered to be the 2.0 version of Mastercoin. The actual token for Mastercoin did not officially launch until July 31, 2013 and the first transaction didn’t occur until August 15. An ongoing flow of funding continued after testing was completed within the system. One of the largest investments in this system was by BitAngels. This was considered one of the largest investor network incubators for cryptocurrency startups and they were able to funnel money into this project to start the framework for smart contracts.

The fundraising process with Mastercoin also set up a Bitcoin address. As long as users were able to donate .01 BTC they would get one Mastercoin in return. The company was able to raise an additional US$500,000 using this exchange method. Mastercoin was never a widely adopted format and at the highest level, it was traded at .25 BTC, which does give a considerable value for initial fundraisers.

In the year 2015, and in an effort to rebrand Mastercoin changed its official name to Omni. The overall goal of this rebrand was to push themselves past some of the critiques, outrage in the community and the bad reviews that they had received. By beginning with this fresh start, it would be possible to have some of the initial members including the founder and the cofounder of BitAngels to associate themselves with a brand-new token. Omni was unfortunately undervalue and only reached a high trading .0 .0041 BTC.

Many have followed in the footsteps of Omni and mastercoin and without the history of these ICO’s and the framework that they created it would be very difficult for other companies to generate the same success from smaller investors all over the world.

4-The world’s most successful ICO’s:

No ICO was able to raise several million dollars until the year 2017. Ethereum is widely considered to be one of the gateways for ICO’s and one of the most widely successful offerings since Bitcoin. By the year 2018 Ethereum and its smart contract technology was responsible for raising over $18 million since its launch in 2015. In 2016 the demand for ICO’s was at an all-time high with the overall success of Bitcoin. Emerging partners like DAO launched and then were able to very quickly raise over $150 million in investments in just a few minutes. Initial point offerings between 2017 and 2018 were responsible for nearly $10 billion in fundraising efforts. The market has slowed down since the end of 2017 but the active nature of these investments at this time has generated thousands of initial point offerings.

One of the pioneers of 2017 included an ICO called Filecoin. This is a network that was able to raise $257 million from a series of 2000+ investors. The coin would allow people the right to portions of their hard drive for server space and then exchange the tokens they received for ETH, BTC and USD. The business has only continued to rise in success and it is the perfect example of a unique ICO that launched a business even late on into cryptocurrency.

The top 10 most successful ICO’s Include:

| Sr No. | Project name and ticker | Total amount raised in dollars |

|---|---|---|

| 1. | EOS (EOS) | 4.2 billion |

| 2. | Telegram (GRAM) | 1.7 billion |

| 3. | Dragon Coin (DRG) | 320 million |

| 4. | Houbi Token (HT) | 300 million |

| 5. | Filecoin Futures (FIL) | 257 million |

| 6. | Tezos (XZT) | 232 million |

| 7. | Sirin Labs Token (SRN) | 158 million |

| 8. | Bancor (BNT) | 153 million |

| 9. | Bankera (BNK) | 152 million |

| 10. | Polkadot (DOt) | 151 million |

- EOS: EOS was able to raise over 7.1 billion ETH or 4.2 billion dollars on their final day of funding. The EOS ICO was available for investment for 350 days and the investment. Finished up on 1 July with massive funding.

- Telegram: As the number 2 ICO of all time, they were able to raise $1.7 billion even without ever offering their coin to the public. To private ICO sales that attracted 81 investors contributed the initial $850 million. 94 other investors were invited to a second presale the generated another $850 million in investment. There was no need for this ICO to crowd source and they received the funding that they needed before the launch.

- Dragon Coin: this ICO was able to raise over $320 million by attracting investment market that’s interested in the casino gambling industry. The coin is designed to enhance online and physical casinos with their own ICO.

- Houbi: This is a blockchain loyalty points system that could be exchange for discounts. The Houbi exchange is a popular cryptocurrency exchange and users could trade the tokens that are offered here for substantial discounts on their trading for cryptocurrencies like BTC or ETH.

- Filecoin Futures: Filecoin raised $257 million and was one of the first ICO’s to fall within the newest SEC regulations concerning initial point offerings. As the SEC now has laws concerning ICO’s investors knew that this would be a secure solution with measures in place to ensure the future legality of the coin.

- Tezos: Having raised $232 million, this ledger is considered to be a distributed and self amending product that builds smart contracts. Token holders can approve and fund brand-new protocol updates. Tezos will continue to scale alongside the new updates as well as handle future disputes within the network using its smart contracts.

- Sirin labs: Sirin Labs got started with raising $158 million. The program is aiming for the use of blockchain technology through mass adoption. The overall focus is to continue developing the secure hardware and offering monetization through microtransactions in the network. The Blockchain network is still in testing but they are hoping to revolutionize the hardware for an ICO network.

- Bancor: This network raised $153 million. The goal of this solution is to allow the average individual to issue their own cryptocurrency. The benefit of this ICO is there’s no need for a secondary party for exchange. The smart tokens within the network allows for the quick exchange of BNT into ERC-20 with planned exchange tokens on the way.

- Bankera (BNK): having raised $152 million, Bankera is widely focused on the idea of building the first financial institution in Blockchain. The ICO isn’t going to be charging any fees on the tokens for trade amongst any pair. BNK tokens can be bought and traded without fees in order to fund the network and the eventual formation of a physical financial institution.

- Polkadot: With $151 million in funding, the goal of Polkadot is to build a heterogeneous multi-chain and scalable currency. Rather than focusing on a single blockchain, the technology here uses something closer toa relay chain that can deliver dynamic data structures and multiple levels of validation.

5-What is EOS and Ethereum?

Filecoin and DAO are two very large crypto projects that have used the Ethereum network to build and launch their ICO. With so many Ethereum alt coins available now it can be difficult to keep track. EOS is an alternative that is commonly confused with Ethereum coins or Ether.

EOS is one of the newest projects that was launched that models Ethereumblockchain, with some improvements. The overall goal is to build a network that capable of processing transactions much faster. EOS hasn’t completed their product and at this stage it’s just a theoretical idea. The overall goal of EOS is to have a platform that is something that would function more like an operating system. OS is in the title for a reason and the overall goal would be to solve problems within Blockchains with smart contracts by processing these tasks much faster. Being able to solve millions of transactions per second could help to create a smart contract system the world could really rely on.

The fastest rate for smart contracts solving currently lives with Ethereum which can typically handle around 15 transactions in a second.

The EOS ICO is considered to be something that could overtake Ethereum as the primary Blockchain for development. With its ability to process data faster for scalability, the network could overcome some of the main problems that are currently being faced with Ethereum. When there are more than 15 transactions per second, operations often stack up within Etheruem. As more people continue to depend on this network for trading, it can often take minutes for a transaction to complete.

To fund the EOS network, the company launched its own ICO. They got started on June 26, 2017 with the end date for investment June 1, 2018. With only 350 days for investment, it is considered to be one of the longest running rounds of investment.

Over the 350 days it was open, the company raised $4.2 billion in Ethereum. This is why EOS is considered to be one of the most successful ICO launches ever. The company currently has 700 million tokens in distribution which represent 70% of the total supply. The company is also in good hands for the future of investment being overseen by Daniel Larimer who is the cofounder of Steem and Bitshares.

The big attraction with the ICO for this product was that investors could one day see results for their initial investment in real time with the brand-new network. The price of the investment is set to increase dramatically when the network is released as well.

6-What is the difference between NEO and Ethereum:

NEO is close to the number one spot with Ethereum and other major players. It’s a relatively new program that is built to make improvements on Ethereum, but in a different way than EOS is tackling progress within the network.

Neo is different from Ethereum in some of these top ways:

- It can handle faster transactions of about 10,000 per second.

- The support of the community is offered in multiple programming languages including development in Java, C# and C++, there’s also a brand-new programming language for smart contract development they has been named solidity.

- NEO is built with two different coins. GAS and NEO will both be placed up as offerings. Wy holding NEO you’ll be rewarded with GAS which serves as a dividend.

- Ethereum is divisible into smaller unites but NEO cannot by divided out of whole numbers. This offers more incentive for holding the cryptocoins.

- NEO is government supported with the help of the Chinese government. Ethereum is not currently supported by the Chinese government so the coin investment is missing out on a massive number of users.

7-Coins vs tokens?

When we look at the popular examples of EOS, Ethereum, Neo and more it’s difficult to understand the difference between coin and token. By looking at the cryptocurrency more in depth we can see that coins are more related to the blockchain they are created on. This is why the bitcoin blockchain produces the coin Bitcoin. Tokens are offerings that are built on top of another blockchain. Ether would be an example of a coin for Ethereum but the hundreds of other cryptocurrencies built on this network are considered token offerings.

8-Can you just create your own cryptocurrency?

If you are interested in creating your own cryptocurrency, you will need to first decide on the ideal Blockchain for building it. If you wanted to build your own cryptocurrency on an existing blockchain they can often be much faster. Building your own Blockchain takes a considerable amount more funding and time.

Regardless of whether you’re creating your own Blockchain or creating a token offering for an existing blockchain, you will need to build an application for your coin. The app will run on your blockchain of choice and be responsible for logging trades of your cryptocurrency.

Some top considerations before starting your cryptocurrency include:

Do you have developers? If you are building an ERC20 token, you will need to have developers that are proficient with solidity, the main programming language for the Ethereum network. If you are going to make an NEP-5 token, you will need proficient developers in Java and C++. To build smart contracts, you may also need to crowd fund legal professionals and further developers.

Is your token/coin going to solve a problem? Creating a new cryptocurrency won’t often lead to mass adoption unless you are doing something original or solving a problem with current cryptocurrency.

How will you handle testing? Testing is often done with a code audit of experienced hackers who will test your system before it goes online. A code audit will help to examine various plots where you could face malicious attacks and more.

Can you pitch your product? Building and informative white paper, pitch deck, roadmap and website for your product to get people excited about the idea and help you secure new investment.

Any business data surrounding a cryptocurrency needs to be extremely easy to read and able to cover some of the major points of a product. Building a white paper could be best done with the help of a professional. You need to be able to create a very strong idea and make sure that when a potential contributor is going over your pitch, that they can have most of their questions answered in a simple format. The best white papers often contain professional illustrations and visual guides that can showcase the advantages of a new cryptocurrency and how it is set to change the market.

White papers are usually formatted in a PDF that can make sure that it’s very easy to share and copy written. Making sure that the white paper is not easy to edit but also very easy to distribute is a great idea. You may want to consider the idea of hiring a professional writer to explain the product to contributors in a high-energy format. Keeping the data relevant and building significant points in a concise pdf data sheet will take formatting and time. It’s usually best to keep the pitch very short so that people will stay interested.

ICO’s often have international appeal so translating your white paper into multiple languages can also be very beneficial to attracting worldwide investment. Constructing and then distributing your white paper to potential investors will take time, but it can ensure your idea can launch.

9-ICO ban and marketing:

ICO’s have encountered a number of challenges since they first started in the year 2013. Raising such a large amount of money for a product that hasn’t even been built does come with a series of downfalls, especially in marketing.

Mailchimp, facebook, and google have currently banned ICO advertisements from their paid advertising support. This occurred after a series of ICO’s crowd sourced fraudulent projects and took the funding money without any intent to ever build a product. This is also part of the reason why many ICO’s are now developing protected data and educational materials to protect their investors.

This advertising ban has really cut into the marketing efforts that are available to many ICO launches. Most of the time, initial ICO news will actually occur on forums and through cryptocurrency/blockchain communities online. Channels like telegram, Reddit discussions and discord are often some of the most popular ways to find out about the latest ICO investments.

Some of the largest communities of cryptocurrency enthusiasts now have over 100,000 members all communicating with in the community and sharing news. Even though marketers have had to be more discreet, these large groups offer a highly targeted audience with a very inexpensive method for marketers to take advantage of. By simply joining into these groups people launching their own ICO, can share their pitch with hundreds of thousands of potential investors without spending anything.

10-Conclusion:

If you would like to participate in an ICO it’s extremely important that you do so with the proper research and caution. There are plenty of opportunities for investment and as a company continues to grow you can often see an excellent yield from your initial investment. Cryptocurrency can be inherently risky for those that are willing to put in the time and research.

As cryptocurrency is a multibillion-dollar investment industry there is a significant loss for investors that happen almost every day. The volatility of some tokens and coins can shift as soon as technology changes or as soon as a new blockchain comes out that offers better support. Tracking and investment and organizing yourself as an investor can lead to many potential profits.

The future of Blockchain technology requires investment however. The future projects that investments could find could completely change our world financial structure. Organizing an initial coin offering can be a wonderful way to fund a business or future technology that could benefit the world. There are dangers on the side of people launching their own ICO as well. Creating a successful ICO launch requires a well thought out campaign, a dedicated team of knowledgeable software experts as well as extensive public support in investment. As some of the top funded ICO’s have shown us however, there is definitely a large market for investment worldwide.

Do you want to learn more about ICO’s? Follow us today and read our next article about what is an ICO?

Do you want to learn – How to Get Access to the World’s Best Paid Crypto-Trading Signals in one channel! To take your game to the next level, sign up for my CRYPTO-WEALTH SECRETS at.

https://crypto-wealthsecrets.com

And if you want access to get access to the Crypto Trading Course you can access it here:

https://crypto-millionairesecrets.com

And be sure to join me on social media to stay updated on MasterTechnique cryptocurrency news.

Connect With Me