If you are an avid investor it is likely you’ve heard of Bitcoin. Since the massive scale of investing back in year 2017 more people have been trying to understand what Bitcoin is and how it actually works. Bitcoin is a phrase that is named after a coin value as well as a Bit.

The one’s and zero values that can be found in most modern computer applications are called bits and this makes up just one half of the name. Coins are the monetary value that we often attached to many worldwide currencies. Bitcoins represent digital currency and the name was founded off of the combination of these two names.

Every Bitcoin is stored within the blockchain which is in turn stored on various computers around the world. The concept can be quite difficult to manage at first but it is possible to really simplify the idea for beginners too. By completing this guide you will have an early understanding of what this currency is and how it actually works. Lets get started with explaining Bitcoin.

Why was Bitcoin Invented?

In most cases with investments there are three areas of interest that start first with the producer of a particular product, the end consumer as well as a middleman or distributor. The problem with each level of this traditional form of investment in distribution is that everyone takes some form of fee. There’s always a distributor or middleman that’s going to take a large portion of the producers money and sometimes this can be between 30 to 50% of the overall profits.

Bitcoin sets to change the idea of transaction fees. By removing a middleman or distributor such as a financial institution it’s possible to make a quick transfer without having a number of administrators that need to be employed to oversee that transfer. Sending international currency to a friend through a bank could have you paying transaction fees that measure in hundreds of dollars with a larger transaction.

In the wake of the financial crisis in 2008 many people became quite distrustful of banks and suggested that they had far too much power over regular day-to-day finances. Bitcoin was created first in the year 2009 and was the perfect answer for many of the issues within the financial crisis.

Bitcoin’s creator is widely unknown and the name that was used for the first transaction was Satoshi Nakamoto. Nobody knows the real creator as this is simply a fake name. Several people have come forward suggesting that they have created Bitcoin however.

The big solution that Bitcoin provides is a prebuilt system that has zero financial authority such as a traditional financial institution. The powers given instead to the people. A new currency was created with a decentralized system. This means there’s no need for regulatory system like PayPal, a government, a bank or other items. Although this seems like a threat to security, when you start to understand more about how Bitcoin works, it makes complete sense why there’s no need for a regulatory body.

How bitcoin works:

There are three major concepts that you need to understand before you can get into the idea of Bitcoin’s inner workings. The concept of cryptography, supply and demand and understanding decentralized networks.

A Decentralized Network:

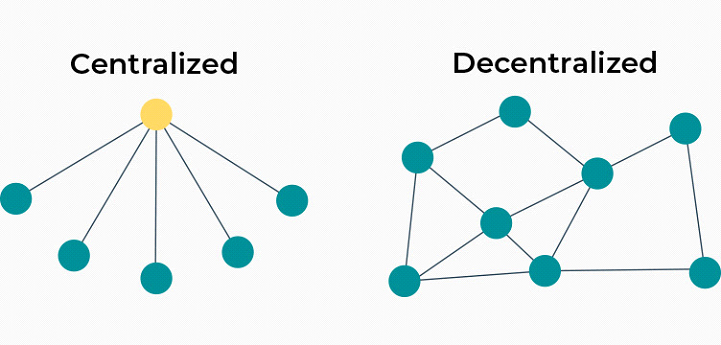

When you type in a web address this starts a conversation between your computer and the server that it’s hosted on. When both computers are able to span a connection it’s possible for you to view the buttons, images and links that make up that page. If the website administrator had the servers shut down with the information on it, you would be unable to access it in the future. This is a centralized network.

With a decentralized network the data is hosted everywhere in a widescale network. You can always access the data because it’s hosted on many different computers and not just in one space. This type of technology can ensure the service won’t ever go down.

Cryptography:

This is a system that was first used in World War II to communicate radio messages in code. Converting coded messages back to the original messages required keys and these were often advanced mathematical formulas. Bitcoin utilizes a form of cryptography in its own messages and ledger updates. All of the transaction data across the network is encrypted and this large encrypted ledger is called the Blockchain.

The creator of bitcoin was responsible for building this technology and blockchain technology today is found in a wide range of computer systems and in many banks too.

Supply/Demand:

A great example of the concept of supply and demand comes down to a café owner. They may be down to the last three cookies of the day and five people come in wanting one. The regular price of the cookie is three dollars but the first person suggested that he could buy all three cookies at a price of five dollars each to make sure he was the one that got them. This is an example of how supply can sometimes dictate the price of goods.

Bitcoin has the same concept where the number of Bitcoins are limited so they can only work to increase in value. As more people continue to invest in Bitcoin, the price will go up and eventually as the network expands a bitcoin could become a very rare commodity.

The overall supply of bitcoin is limited and produced at a very fixed rate which decreases over time. The number of bitcoins produced half’s about every four years and there’s only 21 million Bitcoins that can ever be created.

It estimated that around 17 million Bitcoins are in current circulation to there are still new coins being released.

Hopefully these three concepts can help you form a foundation of the basics of Bitcoin. Next were going to move on to how transactions are executed within the Bitcoin network:

How are transactions performed?

To record any transaction within the bitcoin platform, the changes need to be logged in a database. These database structures are very similar to a large ledger.

In eight centralized network these items would be stored in a spreadsheet in one location that was heavily encrypted and secured. Bitcoin uses a decentralized network and as a result the data is shared amongst a distributed ledger that can only be accessed using Blockchain technology. If you’d like to learn more about the Blockchain in depth, be sure to read our guide about Blockchain Explained.

To send some of your Bitcoins to an individual, you would send a digital message suggesting you are sending 2 of your bitcoins to Steve. The message that the transaction has occurred it eventually broadcasted throughout every computer in the network and this is where your message is then stored on the ledger as a transactional record.

Is it possible to fake an identity in bitcoin?

After creating a wallet with Bitcoin you can receive a public key and a private key. Both of these are a series of letters and numbers that are generated by the system. They serve as a username and a password for accessing your Bitcoins. Both of these items can be considered extremely important for accessing the network but one of which you need to keep a secret. People will need your public key in order to send you money and to see that you sent hem money. Your private key however should never be seen by anyone else. Your private key is considered to be your identity and awaiting you access Bitcoins. If someone gets access to your private key takeout access to your wallet and the opportunity to take your coins.

If someone gains access to your private key your identity can be faked. Your public key however does not identify you and the process of exchanging Bitcoins is considered quite an anonymous one. Your real identity is not verified within the network and this means that you’ll never have to send an invoice, address information, your real name and more in order to send and receive transactions throughout the network.

Is it possible to spend coins twice?

Transactions in the Bitcoin network are stored in what is called blocks. These blocks link together in a large series called the block chain. Every transaction has its own public key written on it and you will be able to see the private key written on your own transactions. Each block bears some connection to the block before it and verifies the transactions to ensure that no Bitcoin can ever be spent twice.

If someone ever tried to spend the same bitcoin twice this is what would happen:

Steve sends Tim a bitcoin

The transaction is stored in logged in the Blockchain

Steve Sends John the same bitcoin the next day

The transaction will get verified with the current block on the blockchain

A discrepancy is found by the computers running the blockchain

The last block has Steve’s public key and shows that it has been sent on the current block.

The computers running the blockchain will not allow that bitcoin to be exchanged.

Are the blocks tamper proof?

If someone were to try and change the transaction data in a bitcoin block, they would only be able to change their own version of that block. In a way, it’s like writing your own passage into a printed book. It is only going to change the version that you’re holding in your hand. In order to change everyone’s version of the blocks, a person would have to temper with the D1 percent of the computers on the network.

Could someone control 51% of the computers in the bitcoin network?

This is a feat that would be next to impossible to achieve. Even if someone was able to hack into 51% of the computers on the network which are also called nodes the added level of security with these nodes would likely thwart their efforts.

To add a new block to the blockchain they need to be accessed in a task called mining. The nodes that dedicate themselves to mining are rewarded with newly released Bitcoins. Nodes that are set to dedicated mining are responsible for verifying transactions across the bitcoin network. When the problem is completed a new block is created and the full block of previous transactions is verified. Each block has a new and more difficult solution for miners to solve.

Mining is a process that uses an extensive amount of electricity. In order for someone to maliciously control and hack 51% of the nodes in the network to make a change, they would have to accomplish this:

They would have to change the data in their own block so that Bitcoins were sent to their own key

The hacker would have to dedicate mining resources to opening a new block as the mathematical problem within that block has changed.

The miner would have to donate an outrageous amount of electricity for the processing power required to solve the equation. (Likely more than the value of the bitcoins they could take from that block).

They can continue working out the problem but the cost of finding the solution is often a net loss for the gains they would receive.

Advantages and disadvantages of using bitcoin:

It is quite likely that you’ve heard about some of the advantages of bitcoin as well as a few of its disadvantages. Starting with a few of the biggest advantages of this currency can help you understand why they can greatly outweigh some of the disadvantages. Asking the right questions can help you better prepare for buying bitcoin and knowing what to expect in the future too.

The Advantages of Bitcoin:

- You can receive payments much faster than a bank

- The fees are generally much lower

- The blockchain system is nearly impossible to hack

- This system is decentralized

- Bitcoin is completely transparent and there is no need to trust an authority with your money.

- It is anonymous so you can sign up from anywhere and not submit your name.

- The system is powered by a community and fees are shared.

- There is no need for a lengthy verification system, you can get up in running in minutes.

With no verification you can enjoy anonymous transactions:

Anyone can send funds anywhere in the world with the help of this system. There is no need to know your customer or to have an idea in order to open up one of these wallets. With a traditional bank you’ll be responsible for using your ID and completing a variety of forms in order to open an account. There are still hundreds of millions of people around the world that don’t have a private bank account so it’s very difficult for them to send and receive money. With Bitcoin, they just need access to a computer or terminal where they can access bitcoin and they can be ready to initiate transactions.

International payment transfers:

The process of initiating international payments can be done much faster with bitcoins. Processing an international payment could regularly take three or four days with the help of a traditional financial institution. Sometimes it can take even longer. The minimum fee for a transaction like this often costs between 10 and $15 as well. The overall costs can be expensive and they’re different for each country.

If you send a payment using bitcoin the transaction only takes around 10 min. and although it can sometimes take a bit longer when the network is busy, even slower transactions may only take an hour which is a huge improvement over the three days that a bank can take. The fee for a bitcoin does change based off of how busy the network is but developers work to keep this fee as low as possible. At an average of one dollar per transaction, this remains one of the lowest cost on international transfers.

The reason that Bitcoin can remain so cheap is because the system doesn’t rely on a middleman. There is no need for a system like paypal or a bank. While you know about some of the largest benefits of Bitcoin, it is also important to consider some of the disadvantages on how bitcoin works too.

Disadvantages of Bitcoin:

- Mining can use an extensive amount of electcity

- It isn’t as fast as other transactions or cryptocurrencies

- The fees can often change

- It is anonymous and can be used for illegal goods.

- Can be difficult to understand.

As bitcoin is nearly 10 years old there are a number of cryptocurrencies that have somewhat overtaken the complexity of bitcoin now. With newer cryptocurrencies that can be widely considered newer and more technologically advanced, there are many investors that are getting out of Bitcoin in favor of other currencies.

Fees are also starting to raise and when the network is very overloaded or a person is making a large transaction may could pay as much is $28 for a transfer. There are many people using the network today and although transfer fees did at one point reaches high as $28 the fees have been reduced back down to around one dollar for the network as a whole.

The use of bitcoin does often require a bit of education. Financial institutions will often help with transfers or have people on hand to assist their customers. Bitcoin isn’t an easy system to use it requires a person to do their own research to get into it. The early adoption of Bitcoin may seem confusing today but the information is becoming widespread and trading technology is growing easier-to-use. Many have compared Bitcoin to the same type of technology gap is when people started to use web browsers many years ago.

Electricity costs are astronomical for mining today. Miners dedicated to unlocking new Bitcoins have to watch their electricity costs very closely to make sure that they are keeping a profit. Mining bitcoins with a heavy-duty Reagan actually be poor for the environment. Lisk and NEO are new crypto systems that require far less electricity to mind because they are using proof of stake technology.

With bitcoin, a miner is responsible for verifying the block and this is called proof of work. Proof of work has all miners verifying the same block at the same time almost like a race to the finish, pos has one minor mining one block and allots the next block to a new miner. This is a much cheaper and environmentally friendly option.

Criminals using bitcoin have made news throughout the years. One of the most popular applications that was accepting illegal goods for bitcoin transfer was Silk Road. On this network people were doing everything from buying illegal firearms to drugs and services like prostitution. The network was shut down in 2013 by the FBI but it still gets associated with Bitcoin. The anonymous crimes that were carried out through Bitcoin are some of the negative aspects of what could happen with these currencies.

How can I get started with buying Bitcoin?

Broker:

The easiest way to get into bitcoin is to begin with your identity. By using your own name, passport, address and driver’s license you can join a broker exchange. Most exchanges will allow you to buy and for transaction fee of between 1 to 5% of the total amount you’d like to invest. The fees with each broker exchange can vary based off of your location. You can get started with PayPal, credit card, debit cards or bank transfer. One of the easiest to get started with is Coinbase in USA but you can also start with a platform like Coinmama.

When you start with a brokerage exchange you just need to exchange your current currency for the Bitcoin value.

ATM:

There are bitcoin ATMs that can be found throughout the world. This is an easy way to you can access bitcoin using your debit card, credit card or cash. The fees on these machines usually range between 5 to 10% and you just need to follow the instructions on the screen to access your bitcoins.

P2P exchange:

These are items where you don’t have to use a broker, instead you can enjoy a private exchange between yourself and someone that has Bitcoin. P2P exchanges do use escrow. You can ask the user for their value of Bitcoins, the Bitcoins are sent to escrow, you pay your fees and then the Bitcoins are sent to you when the contract is met for escrow to release the funds. This is the fairest way to trade between individuals. It is even possible to use P2P exchanges with just a username staying anonymous. LocalBitcoins is a great place to get started here.

Conclusion:

Bitcoin represents a revolution in finance and Bitcoin seems to only be getting started. There are people around the world today that are using cryptocurrencies instead of their own banks but the system hasn’t completely replace traditional financial institutions. Based on what you have read here and some of the advantages, you may see just how Bitcoin may replace traditional financial institutions in the future. What improvements do you think Bitcoin needs to make before it can compete with traditional banks? Do you think Bitcoin could replace your own bank?

Work at answering what Bitcoin means to you and how it works in 3 to 4 sentences. This can be a fantastic way to show what you’ve learned in this article. Try it below and post your summary to share your thoughts with the other users!

Do you want to learn – How to Get Access to the World’s Best Paid Crypto-Trading Signals in one channel! To take your game to the next level, sign up for my CRYPTO-WEALTH SECRETS at:

https://crypto-wealthsecrets.com

And if you want access to get access to the Crypto Trading Course you can access it here:

https://crypto-millionairesecrets.com

And be sure to join me on social media to stay updated on MasterTechnique cryptocurrency news.

Connect With Me